Pondering IFE post-COVID

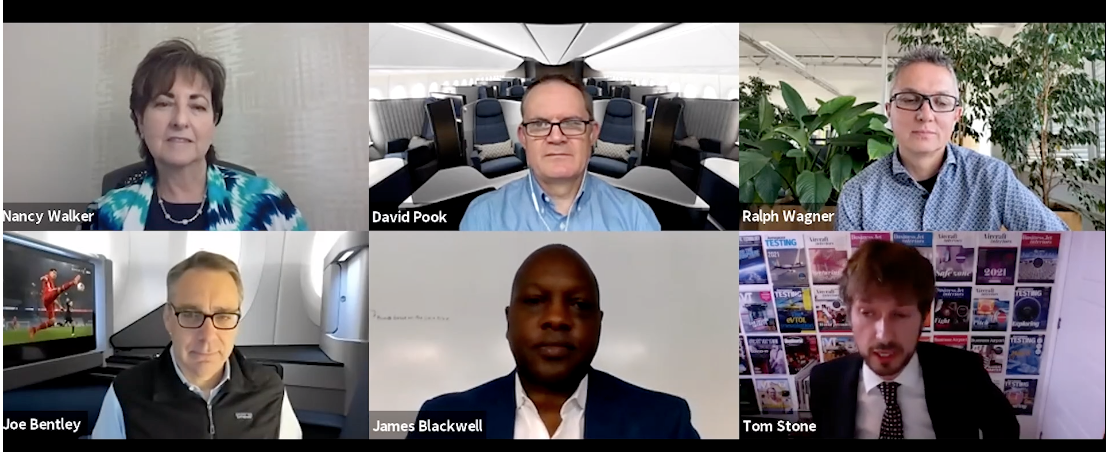

Panel: Clockwise from left: Nancy Walker of Global Eagle; David Pook of Burrana, Robert Wagner of Axinom; Tom Stone of Aircraft Interiors International; James Blackwell of Delta Flight Products; and Joe Bentley of Panasonic Avionics

In the near future, airlines may be encountering a passenger who is not quite as frightened to take to the skies as originally expected and is anxious to return to travel.

People have spent the last year dealing extensively with life online and passengers will be bringing screens and phones onto the aircraft in greater numbers than had previously existed. On those screens, passengers will expect to access their own content. This could see influence of blockbuster movies waning further in COVID-19’s wake.

A discussion devoted to the future of inflight entertainment and connectivity at the FTE APEX Virtual Expo 2021 brought in players from several of the world’s major suppliers, along with Air Canada and Delta Air Lines’ new spinoff company.

Tom Stone, Editorial Director of Aircraft Interiors International moderated the one hour session. On the panel was James Blackwell Jr. Managing Director of Sales for Delta Flight Products; David Pook, Vice President of Marketing and Sales Support for Burrana; Nancy Walker Senior Vice President Aviation Connectivity at Global Eagle Entertainment; Joe Bentley, Chief Technical Officer at Panasonic Avionics and Ralph Wagner, CEO, Axinom, a software company. Toward the end of the discussion, Norman Haughton, Director of Inflight Digital Entertainment, Wi-Fi, Media Sales and Analytics at Air Canada gave his assessment of the last year and what the airline planning for its passengers.

Naturally, developments in the narrow body aircraft marketing have taken center stage as international travel and business travel has stalled in the wake of the COVID-19 pandemic. But what Panasonic has seen in the passenger demand for IFEC has not followed the downturn.

Demand for inflight Internet has increased three times faster than passenger growth, says Bentley. One of the main reasons cited was the availability of over-the-top (OTT) streaming through which a passenger could bypass cable and broadcast and satellite video and access content directly over the Internet. Research by Panasonic also showed that passengers were less squeamish about working with touch screens and other areas of the cabin than may have been expected.

“I think that comfort that passengers have with touching things in the cabin is really a testament to the remarkable job that the airlines did in cleaning the cabins and helping the passengers and crew feel safe,” he adds.

A year without major sporting events that are traditionally popular has also fueled consumer demand for live streaming, says Wagner. This will drive a desire to quickly install services onboard aircraft and uninstall them as needed from the ground. An efficient purchasing process will be important to airlines and the companies that supply them. Making money with the Internet service is still a challenge, he adds.

The potential of inflight entertainment as a profit center has led to some stops and starts Nancy Walker from Global Eagle Entertainment. However, airlines producing revenue through IFEC is going to take place with the new technologies she sees around the world and leaving from the Space Coast of Florida.

“I see launches go up every almost every week and maybe twice a week,” she says. “Before it used to be one satellite now they carry multiple (satellites).”

IFEC is lagging behind other segments of the entertainment world, says Bentley. He mentioned the term “engagement minutes” which Panasonic calculated at 1.4 trillion in the inflight entertainment industry, which he pointed out is approaching the size of online content provider YouTube.

“You consider the opportunity for advertising you can drive probably a billion (dollars) in revenue or more off of a number like that,” he adds.

Pook adds that the evolution of complementary connectivity in the hotel industry is something commercial aviation has definitely watched over the years. An approach that both saves money in installation and allows travers to use the service to shop or book activities at their destination.

Delta’s spin-off

Stone started off the discussion by asking Delta Flight Products’ James Blackwell, Jr. about how the airline decided to form the subsidiary that is now offering products and services to other airlines.

The company has designed an inflight entertainment system that streams content wirelessly to the seatback. The lack of complexity from other systems allows Delta Flight Products customers to make changes quickly and easier with less weight. The airline launched the system with a 13-inch screen on its A220s in First Class.

“We are developing systems that allow you to more easily manage content as well. So what we have tried to do with the development and design of the system is a think through a lot of the pains that airlines have when dealing with IFE systems and kind of design around those so that so that you can improve the overall passenger experience,” Blackwell says.

Air Canada’s Norman Haughton wrapped up the one hour session. He says Air Canada is using its inflight entertainment system as a “strategic tool” to help in the industry turnaround. Air Canada plans to tailor its IFE offering to leisure travel, which will dominate the industry in the near future. Wi-Fi will be important to business travelers when they again return, to the sky, Haughton said. Additionally, the airline will continue an initiative to use its IFE to inform passengers about their activities in areas, such as sustainability. Haughton says that passengers aboard Air Canada are demanding Wi-Fi in greater numbers, and that will continue as there remains uncertainty about health directives and information at their destination.