Still to be determined: if 2021 will be the year of recovery

Considering airlines, airport operators, on-site airport employees and civil aerospace, it’s believed that approximately 4.8M jobs (-43 percent) directly connected to aviation will be lost due to COVID-19

During a Duty Free World Council (DFWC) webinar this week, entitled 2021 - Year of Recovery?, it was made known that the question mark is a requirement of the title. Hosted by Duty Free World Council, the webinar provided both an international and regional outlook on the travel industry’s current state and future of recovery. Featuring Patrick Lucas, Vice President of Economics, Airports International Council (ACI) World, he reports that the future of recovery is made up of “known unknowns,” which creates some degree of randomness and makes it challenging to offer predictions. He says that governments continue to act and react unilaterally overall and the estimated total airport industry losses amount to USD$112 billion in 2020.

“[A recovery of the travel industry in a reasonable timeframe requires governments to introduce a consistent testing process to promote travel and move away from restrictive quarantine measures with a coordinated and risked-based approach, which combines both testing and vaccinating as a way forward,]” he shares.

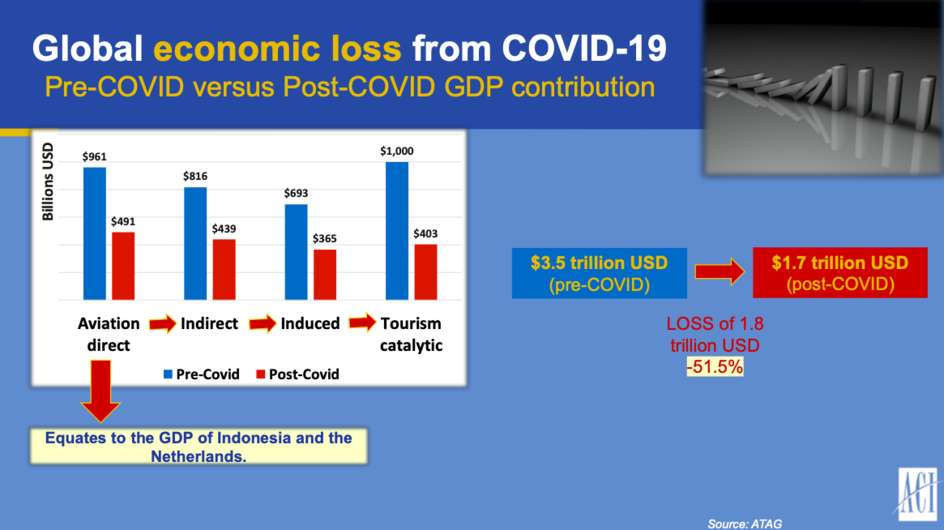

Describing the last decade (pre-COVID-19) as “the golden era of travel,” with Q2 of 2020 taking the hardest hit, global passenger traffic last year experienced a 63 percent decline as compared to the projected baseline. A simple breakdown of the numbers: the revenues of the 85 busiest hubs in the world were completely wiped out. Listing the direct, indirect, induced and tourism catalytic global socio-economic impact of COVID, Lucas addresses both on-site and off-site employment that is supported by aviation.

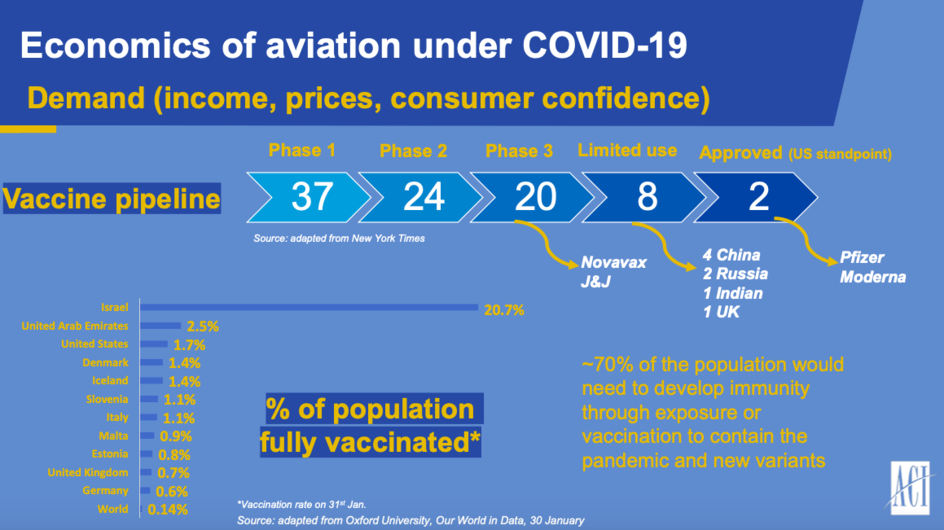

A repetitive message among those participating in the webinar: the need to re-open borders safely, improve consumer confidence, support continued digitalization (i.e. develop IATA Travel Pass to create a digital passport and share test or vaccination results with authorities in order to facilitate travel) and experience a strong vaccine pipeline. It’s reported that 76 percent of passengers will not travel if self-quarantine is a requirement.

A snapshot of the global vaccine pipeline, which is significantly led by Israel and notes that COVID-19 infection rates will dictate travel destinations

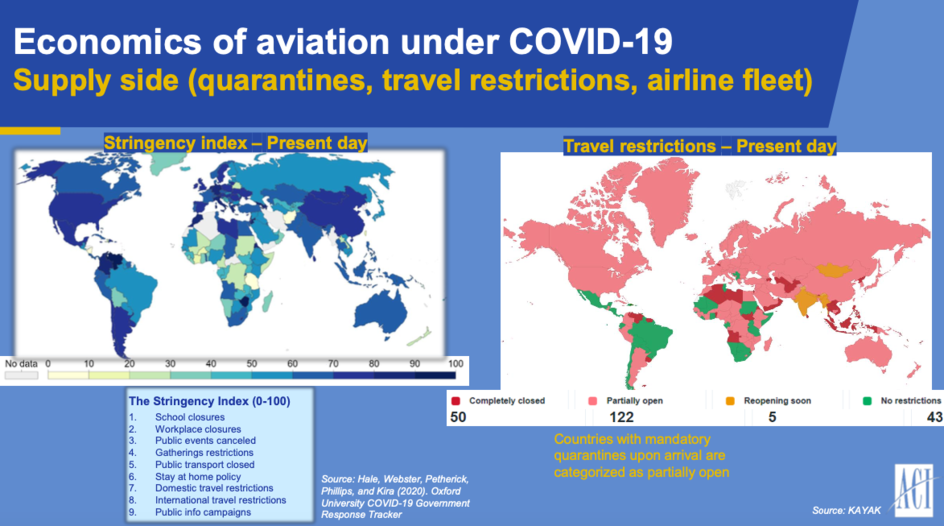

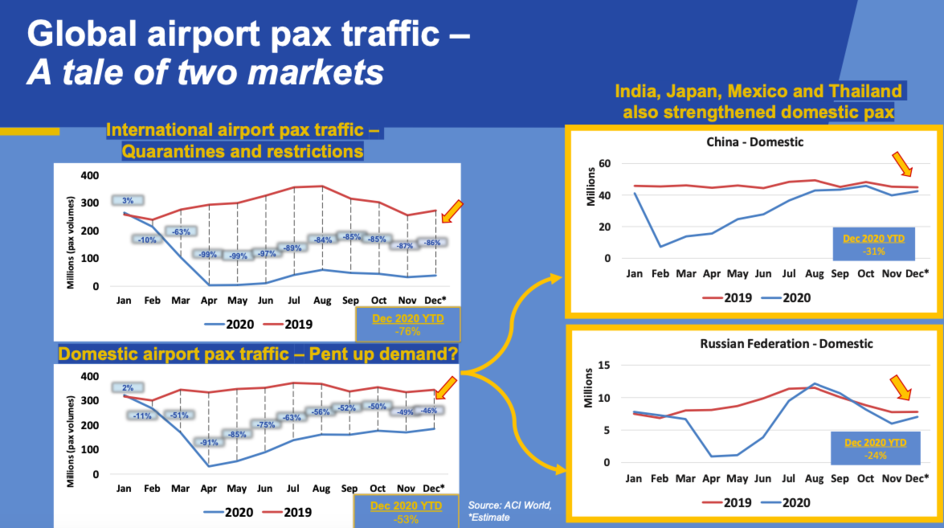

Switching from demand to supply, short- and medium-term travel restrictions, quarantines and airline capacity reductions will shape recovery. Described as “a tale of two markets,” domestic travel is expected to recover more quickly than international travel and return to 2019 traffic patterns, passenger volumes and retail sales in 2023 due to pent up demand.

A closer look at the supply side of the industry and present-day global airport pax traffic, which shows the Stringency Index per-country and year-on-year pax traffic on both a domestic and international scale

Looking ahead, the fastest growing emerging markets for pax traffic from 2020 – 2040 include Vietnam, India, China and Indonesia, respectively. Approximately 40 percent of the world’s population currently resides in these countries, which helps to support the forecast that within the next 20 years, 45 percent of global traffic will pass through airports in the Asia-Pacific region.

Although vaccine deployment and uptake remain to be “known unknowns,” Lucas points out that the long-term fundamentals of air transport still apply – markets with an expanding middle class and working age population will continue to serve as the foundation of the industry. An upside to the global crisis, the respected economist concludes that the impact of COVID-19 has fast-tracked innovation and technology across the channels, categories, trades and teams and introduced NEXTT: New Experience Travel Technology – a vision for the future of air.