A look at independent caterers in Asia

This is a special feature from PAX International's April World Travel Catering and Onboard Services Hamburg 2020 edition.

Royal Brunei Catering is building a new centralized kitchen that will open this year

Much is heralded about the way Asia is the game-changing market. Watching the dismantling of LSG, the merging of gategroup, SATS and Servair, and the growth of dnata demonstrates the degree of turmoil generated from the East in the current airline provisioning sector.

There will be winners and losers across the industry. Winners should be the providers who successfully compete against the monoliths. Some say the losers will be airlines who dislike the reduction in capacity and consolidation. But, in Asia, this volatility only adds concerns to other influencing factors, not the changes to the provisioning business models.

Smaller caterers are exposed on a number of fronts. Airline catering models, global agreements with big operators, the rise of brokers, changes to routes and price pressure, the rise of low-cost carriers put extreme pressure on the independent or smaller chain caterers.

Pos Aviation – Kuala Lumpur

My first stop was Pos Aviation at Kuala Lumpur International Airport. This stand-alone operation started life as a Eurest unit until it was taken over by the Kuala Lumpur Airport Services. The catering operation is part of a large number of services managed by the company that is now under the umbrella of the national postal service.

I met with General Manager Ramzanee bin Ramli to talk about how the business was performing under turbulent conditions.

“For years the distinction between us and our colleagues across the road (Brahim’s) was very clear. They were MAS (Malaysia Airlines), we weren’t, but now it’s changing” says Ramli. The competing operation was originally built as MAS Catering and became Brahim’s before merging with LSG. They have now gone and SATS are the managing cooperatives. Pos Aviation now also catering flights for Malaysia Airlines.

Ramli goes on to say that “The big changes for us have been the increase of LCC traffic, specifically Air Asia.” Kuala Lumpur is a hub for Air Asia and the airline procures much of its product from its own providers, but still works with traditional caterers for ramp services.

I asked what is being done to mitigate the loss of business and to maximize the use of capacity. Ramli explains, “Efforts are being made to seek out new non-airline markets and we are already delivering 30 percent of output to the food service sector and events. The issue is that our sales force is experienced more to the airline world and our production designs are geared for that. So, we have to carefully manage any additional production to ensure it doesn’t disrupt our core business”.

This, as I find out later, is a common thread and one which is tackled in some interesting ways.

Pos Aviation was built to be an inflight catering unit in the days when the idea that it would produce for other markets was not necessarily considered. That being said, with skilled process management, producing for other markets is increasingly necessary. With currently 70 percent of POS’s output for the airlines, what is the company’s plans for the future?

“We are optimistic” says Ramli. “We are delivering to around 14 airlines and now also uplift to MAS on some India and China routes, but we are not at capacity. However, we are still taking steps to secure expansion because we see the growth for the non-airline sector as inevitable.”

Aerofood ACS - Medan

Traveling to Indonesia, I visited the facility built by Garuda Group’s Aerofood ACS at Medan’s new airport Kualanamu International Airport servicing the city of Medan in Sumatra, Indonesia. While Pos was is a stand-alone, Aerofood in Medan has units in Jakarta, Denpasar, Surabaya, Balikpapan, Yogyakarta, Bandung, Lombok and Pekanbaru.

Here we have a slightly different set of circumstances. Recently appointed General Manager Hoerip Satyagraha explained “We had to build an entirely new catering (unit) when the whole airport was relocated to Kualanamu in July 2013, handling all flights and services shifted from Polonia Airport which is now an air force base. In anticipation of growth, we built a facility for 12,000 meals a day although currently the airlines require around a quarter of this capacity.”

And this is the problem. Whilst traffic is growing fast, most destinations are regional and fed by buy-on-board carriers who do not load meals in anything like the numbers of the traditional carriers. Add to this the fact that some foreign carriers can double cater if they choose, and routes are sometimes seasonal. So you can imagine the volatility.

“We have peaks and dips” Hoerip goes on to say, “And we also have to manage the huge volumes around the Haj and Umrah flights.”

So again, they are turning to the off-airport foodservice sector to balance the business to provision nearby factories such as Unilever, offices, event catering and retail.

It is a modern facility with up to date building techniques, so adapting production flows to different models is easier and less disruptive to airline production. I asked about the challenges of selling onto the foodservice sector. The reply was interesting and applicable to all of us in this sector – namely that, besides capacity, is the fact that being airline caterers, guarantees of best practice HACCP and food safety is a given.

“This gives us a tremendous advantage over our competitors in the bulk catering field” explains Hoerip. That is of course until they catch up, which in due course they will. However, from my observation of this unit, any competitor has a long way to go. Equipped with modern quarantining and protection including reverse airflow air locks to get into the kitchen, Aerofood ACS has also attained ISO 9001 Quality Assurance certification and ISO 22000 Food Safety.

Royal Brunei Catering – Bandar Seri Begawan

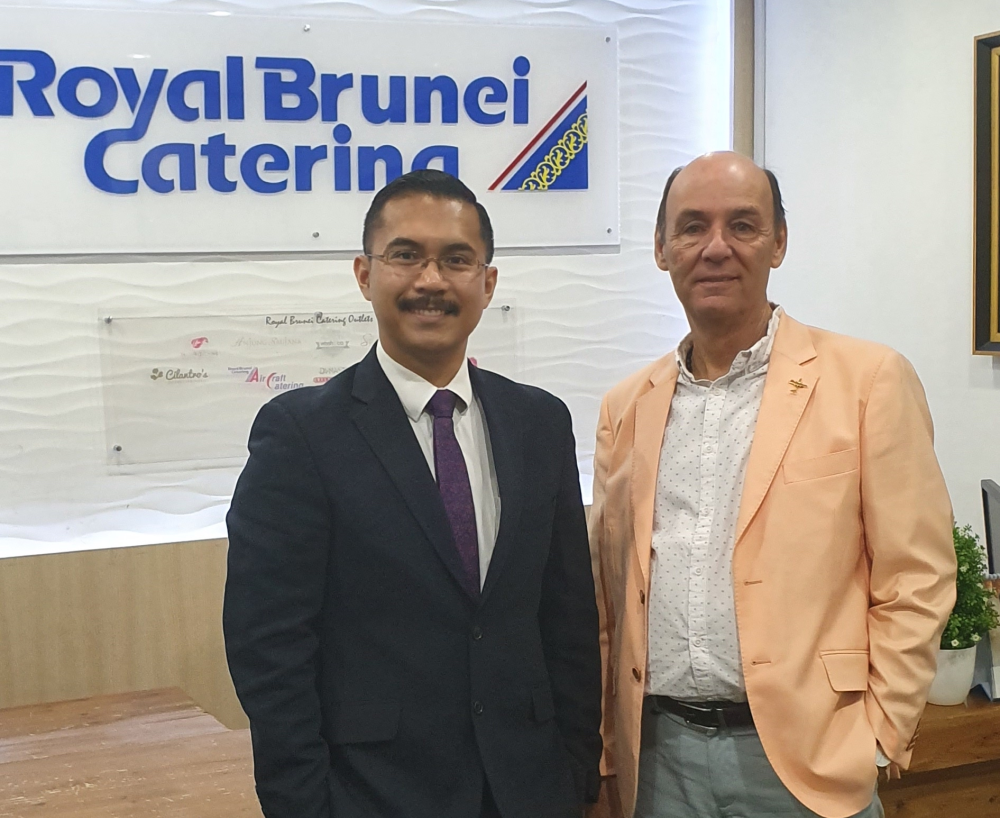

Brunei Catering General Manger Jeff Hadiman (left) with PAX Asia Correspondent Jeremy Clark

Next was another independent single catering operator. One I am proud to say with which I am particularly familiar: Royal Brunei Catering (RBC) on the north coast of Borneo. Greeted by the recently appointed General Manager, Yang Mulia Haji Jeff Hadiman bin Dato Paduka Haji Danial who I’ll happily refer to as Jeff, I also recognized many people still here from when working here as Executive Chef in the late 1980s.

Walking into a unit I helped design and refurbish in 1990 was a blast from the past. Starting life as Dairy Farm (Hong Kong), Royal Brunei Airlines took over in 1989 in time for its growth as a long-haul carrier in the 90’s. Now, RBC is a wholly owned and operated subsidiary of Darussalam Assets Sdn Bhd.

The operation’s production facilities had not changed, but the dynamics of the business has. Whilst delivering to foreign airlines has gone (as they either back-cater or have changed the business models to alternative offerings) the retail and food service sector has grown to compensate.

This has driven RBC to a radical new approach to the future and in October 2019 – they broke ground on a new centralized kitchen and production facility to be completed late this year. Situated on a two-hectare plot on an off-airport industrial site, the new facility will be the first kitchen certified with the Hazard Analysis Critical Control Point (“HACCP”) standard, and the largest of its kind in Brunei Darussalam.

This increases RBC’s operational efficiencies and production capacity. RBC will then consolidate its kitchen operations for airlines, healthcare, special events as well as retail services.

“We need to be much more than just a flight caterer with a few restaurants and outside catering,” Jeff says. “RBC – even since your time Jeremy, (thanks!) is Brunei’s leading provider of premium catering services and food solutions in the country and the new facility will double current capacity, allowing us to cater for future growth opportunities across markets. This includes to both domestic and international customers.”

RBC understands the challenges and made some very bold and wise insurances to secure the future. By consolidation of RBC’s operations, the company will be expanding its support to the development and growth of small and medium enterprises (“SMEs”), and introduce value-added services such as commissary kitchen rentals and competitive procurement of raw materials.

The existing air-side flight catering center will remain and be re-designed as a finishing point for fresh product and manage the day-to-day operations of delivery to RBA, it’s key customer. “RBC’s new facility will support continued growth and development by keeping up to pace with our clients’ needs, allowing us to provide value-added and higher quality service,” added YM Alvin Voon, Aircraft Catering Manager for RBC.

It seems RBC really has taken these changes fully on board to the point of looking at renewing its brand strategy and identity. RBC’s brand will take on a larger national role with aims to provide the highest quality culinary services and food solutions that deliver ‘the taste of modern Brunei’.

So as the traditional big fish swim around in the pool of decreasing competition, decreasing margins, demanding airlines ever more challenging provisioning models and often an unwillingness to deviate from their core businesses, the independent caterers are looking beyond the airfields for growth. Capitalizing on the strict regimes of food safety and quality that airline catering demands, the wide choice of alternative markets is welcoming these newcomers so I expect this business to fly.